Essential protection for your vehicle loan – and your finances.

Protect your vehicle loan – purchase GAP today!

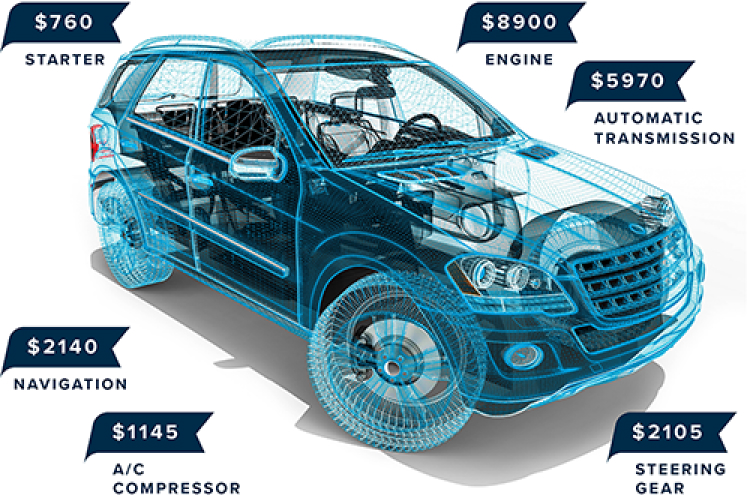

Guaranteed Asset Protection (GAP) covers motor vehicles, powersport, recreational vehicles, and watercrafts, and may reduce or even eliminate the shortfall between what your vehicle insurance will cover and what you owe on your loan if your vehicle is deemed a total loss.

Essential financial protection on your vehicle loan that helps you drive with confidence. Call us at 401-233-4700 and learn how we can help protect you from sudden out-of-pocket expenses with Guaranteed Asset Protection.

Your purchase of MEMBERS CHOICE™ Guaranteed Asset Protection (GAP) is optional and will not affect your loan application for credit or the terms of any credit agreement you have with us. Certain eligibility requirements, conditions, and exclusions may apply. You will receive the contract before you are required to pay for GAP. You should carefully read the contract for a full explanation of the terms. If you choose GAP, adding the GAP fee to your loan amount will increase the cost of GAP. You may cancel GAP at any time. If you cancel GAP within 90 days you will receive a full refund of any fee paid.

Unique ID & Copyright GAP-4718101.1-0422-0524 CUNA Mutual Group ©2022, All Rights Reserved.